Understanding Crypto in Africa

Stablecoins reign supreme amongst a backdrop of Africans who are increasingly seeking employment online with the global community.

I attended a trip organised by Borderless Africa alongside a small cohort including Yoseph Ayele, Songyi Lee, Jeff Coleman, Ye Zhang, Kartik Talwar and Jacob Willemsma.

The trip was split between Kenya and Nigeria across ~9 days.

In each country:

General meet-up for Q&A and Panel Discussion,

Intimate circle discussions led by locals,

Developer educational workshops.

Alongside the meet-ups, we had the opportunity to meet with founders and well-known contributors.

This article represents my own personal views and the insights that I gleaned from all the conversations. It focuses on:

USDT and Binance P2P are Widely Popular

Hunger To Earn On Merit and Not Geographical Location

What Does The Future Entail?

Disclaimer: Every meet-up invited locals to learn about Ethereum and layer-2 protocols. The audience attending these events are very likely to have a keen interest in cryptocurrencies. It may not widely represent the population today, but it may in the future as crypto adoption continues to snowball.

USDT and Binance P2P Are Widely Popular

I asked the same set of questions at every meet-up:

Who gets paid in crypto?

Who gets paid in their local currency?

Who prefers crypto as in BTC/ETH?

Who prefers stablecoins?

Who is actively using Binance p2p marketplace?

Across all meet-ups, the response was fairly consistent from nearly all participants:

They had received a payment via cryptocurrency for their work.

They prefer to be paid in stablecoins with a specific preference for USDT.

They use Binance’s P2P marketplace to swap stablecoins into their local currency (and vice versa).

There was not a significant interest to hold native crypto assets like Bitcoin or Ethereum. Not only that, but participants preferred networks like Tron or Binance Smart Chain to transact.

The reason: Little to no fees with “rapid” confirmation times.

Binance is Popular

While there is a rise in competitors like onboard, nearly all participants continue to rely on Binance as their preferred choice for transacting.

It was explained to me that Binance moved into Africa with Binance labs around 2018. There was latent interest, but no initial plans to expand. It happened over time as Binance realised that African’s wanted access to stablecoins.

It became a significant market for the company and adoption is evident on the ground. I saw several locals wearing Binance swag, but they had never worked at the company.

To me, the rise of USDT seems to be coincidental. In 2018, there was no competition in the stablecoin market and Africa appears to have followed the wider market trend of the time as USDT overtook BTC as the most liquid and traded asset. I wish I had asked more about the preference of USDT over USDC.

Crypto Represents Convenient Access to Stablecoins

The rise of stablecoins cannot be understated.

Stablecoins represent the single most important innovation from the perspective of Africans.

It enables convenient access to the US dollar:

Africans can bypass the local black market.

Africans no longer need to deal with its associated real-world dangers.

Africans can exchange at a rate that reflects the wider market.

Even more, there is no need to hide US dollars under the mattress. It is all digital.

Of course — the work required to enable stablecoin adoption — is not an easy feat.

Some readers may think: “Well, if I can represent a US dollar as an asset on-chain, then I have solved the problem!”.

It is the first step towards solving the problem. The wider issue is creating an online marketplace that can foster a liquid market for swapping stablecoins into their local currency. The market must enable swaps at size and with minimal price slippage too.

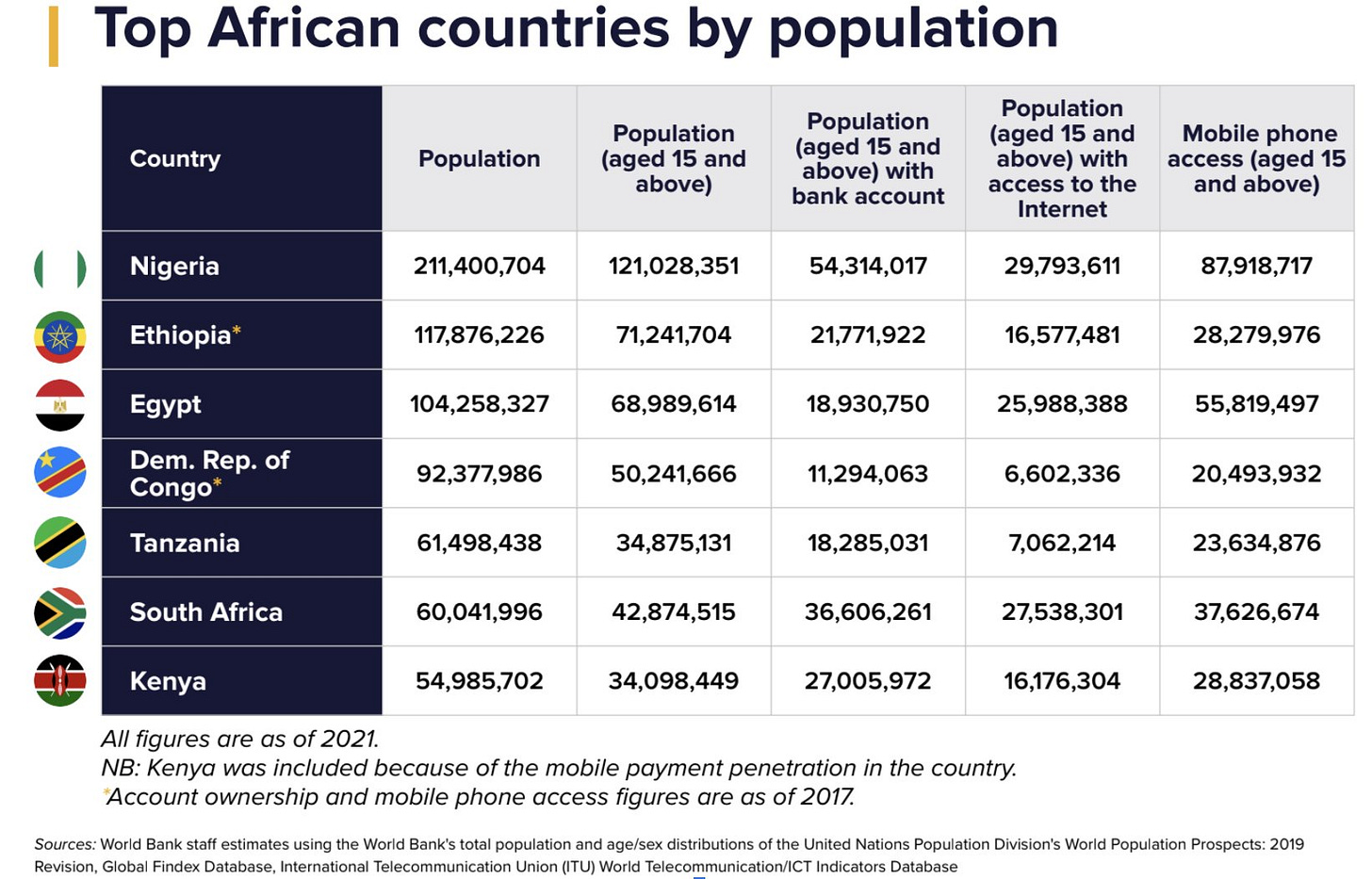

Why is this the true challenge? There are around 42 currencies in the nations of Africa. We need to foster a liquid market that can facilitate swaps for all local currencies with the stablecoin. It requires many local participants to make it a reality.

Thankfully, the one thing crypto rails is really good at is allowing participants to collectively work together and provide liquidity for assets when there is a real demand for it.

So far, this works well in Kenya and Nigeria. I do not have data to confirm this is the case for all 42 currencies in Africa.

Why Stablecoins? And Not Crypto Assets?

It may come as a surprise to many, but local currencies in African nations have devalued at a fast pace relative to the US dollar. Some currencies, like in Zimbabwe, failed due to hyper inflation.

For example — since 2008:

Nigerian Naira has depreciated by 7/8th relative to the US dollar.

Kenyan Shilling has undergone a 50% devaluation relative to the US dollar.

The devaluation for the Kenyan Shilling is remarkable given that Kenya’s GDP has tripled in the same period from 2008 to 2023. The currency continues to devalue against a backdrop of economic growth. Increasing confidence in the economy, but not the local currency.

It may go without saying, but a large swath of the population in Kenya and Nigeria continue to live in absolute poverty.

To westerners, especially in the UK, the idea of poverty is living in a council flat with social security (benefit) payments. Families do struggle to put food on the table, but they have a roof over their head with access to healthcare. If we consider homelessness, there is a population of ~271,000 in the UK which represents 0.4% of the total population (~67m).

It is estimated that 60% of Nairobi’s population lives in a slum. Additionally, the worldbank estimates ~50% in both Nigeria and Kenya.

In the slums, an entire family may live inside a single room (“studio”). Outside their home is a tiny corridor that connects them to the main road. As we experienced, sewage passes through the tiny corridors and it is like an obstacle course to navigate your way through. Many live on <1 USD a day and there is little to no social welfare.

This is why the following statement is tone-death to Africans, especially those living in the slums.

I am not a fan of criticising comments like the above, but it is out of touch with real-world situations and the reality that locals face.

I’m sure locals would love to have long-term saving goals, but they have an urgent necessity to address immediate expenses. For example, if they do not pay their bills for whatever reason, a landlord may pay $10 for a gang of youths with sharpened metal to threaten the tenant to pay their rent.

It is actually remarkable to think that slums still have landlords.

I do not believe even stablecoins can help the people living in slums. The solution is to create better market conditions for the locals to earn wealth, build better infrastructure, and escape the slums. I can see how individuals may seek to work online and receive payments via crypto rails, but that is not a readily available solution to many living in these conditions.

Put another way: Crypto rails is not yet relevant to ~50% of the population in Nigeria or Kenya outside of exceptional cases.

The Africans who use stablecoins are not living in the slums. I’d imagine they have achieved some form of financial stability and they can afford to pay for near-term expenses.

The crypto meme that the US dollar is losing its spending power over time and we should keep all our savings in native crypto assets means very little to them. It is an alien concept.

The opposite is true in Africa. The US Dollar’s spending power is up only relative to their own local currency. It is a far safer bet than holding native crypto assets.

To Africans, the US Dollar is extremely stable and that is why stablecoins have found product-market fit.

To Earn on Merit and Not Geographical Location

The demographics of attendees included:

Community leaders,

Software developers,

Startup founders.

This demographic makes sense since our group represented ETHGlobal, Arbitrum and Scroll alongside a sponsorship by Optimism.

Hunger to Succeed Against a Backdrop of Discrimination and Mistrust

The following questions and answers originate from meet-ups in Nigeria.

Who has issues with online payment providers like PayPal?

Everyone in the audience raised their hand and laughed in tandem with each other.

It is very common to get locked out of services because the IP address in Africa (especially Nigeria) is considered suspicious by online service providers. Some of us also got locked out of our accounts.

The end result: African’s get locked out of services offered by global Fintech companies that we, in the west, take for granted.

Who has issues with KYC?

We were told that ~70% of Nigerians do not hold a passport.

The Nigerian Government have put together a scheme called the National Identification Number (NIN) for identification and KYC purposes, but it is embroiled with issues and delays.

On the other hand, the Central Bank of Nigeria runs a separate identification process called the Bank Verification Number (BVN). It acts as a single identifier for the user across all banking services. Only 25% of Nigeria’s population (57 million) have signed up to it.

Identity is still a hard problem in Nigeria. It will impact the ability for companies to satisfy compliance requirements before funds can be sent to Nigerians. Crypto rails or not — this identity problem that can adhere to regulatory frameworks really needs solved.

Who has ever lost out on an opportunity because they could not trust you?

No one laughed this time.

Everyone raised their hand and looked around the room. It was very sobering.

It is disheartening that locals are discriminated and considered untrustworthy, especially when it originates due to their nationality and geographical location. The Nigerian Prince meme encapsulates this online opinion.

If there is one takeaway to the reader. I believe this is why blockchain technology, and certainly rollup as a technology stack, is so important to our colleagues in Africa.

It diminishes the power dynamics between the user and operator, enabling parties who desire to engage in transactions but harbor mutual distrust, to ultimately carry out transactions in a secure manner with each other.

Put another way, it allows a user to:

Lock funds into an operator’s service,

Interact with the service,

Eventually withdraw their funds from the service

…While not trusting the service operator.

Our ability to define, measure, and reduce trust in a financial interaction, is what makes the crypto space so special. I’ve called it the field of trust engineering for the longest time.

I hope someday the technology stack will be ready to benefit our colleagues at scale.

Allowing us to transact on their platform, pay them a fee for their service, and most importantly, without the need for us to be concerned about who they are or where they live.

What should be the one thing we tell people in the west about Nigerians?

One participant, alongside a few comments by others, gave an insightful speech to this question. I’ve tried to summarise the key points below.

“Nigerians, in particular, are hungry for opportunity. They are driven by incentives. Design the right incentive schemes and Nigerians will come.

Nigerians learn everything they know from the internet. Give them a Nokia 3310 and they’ll use it as a tool to go somewhere.

They want to escape the local environment, work online and join the global workforce. They see the blockchain as the great equalizer. Allowing them to earn on merit and not location.

The amount of money needed for a project to succeed (in Africa) is less. Every $1 spent in the US/EU, you’d get 1 point, but in Africa you’d get 1000 points.”

As another datapoint:

“If there is a Nigerian on the project, then there is money to be made. Be wary if there are no Nigerians.” - A local in Kenya

I laughed, but it really demonstrates that hunger to make it.

Web3 Bridge

Take a second to imagine:

Leaving your friends and family for 16 weeks, traveling thousands of kilometres, to live in a house with 40 others (bunk beds) to learn about Web3.

In the hope for a life changing opportunity.

The opportunity to work online, earn based on merit, and not be discriminated against because of your geographical location.

That is Web3Bridge.

Web3Bridge is an educational programme that has been running, for free, since 2019.

The programme attracts Web2 developers, and aspiring programmers, who want to learn how to get started in the Web3 industry.

We met a woman who left her husband and three kids at home, so she could take part in it. I imagine many others in that room face similar dilemmas on leaving behind loved ones for a long time and that courage should not be understated.

The curriculum and the topics covered are impressive too. It ranges from basic concepts like what is a blockchain, to implementing your first solidity (or Cairo) smart contract, to learning the full-stack for implementing a Web3 application.

Again, the entire programme is free to attend, both in person and online. We learnt the continued existence of Web3Bridge relies on grants and personal investment (time and money) from the founders.

The physical setup consists of a few houses for now, but the Founder Ayo told us about his dream. He wants to buy nearby plots of land and open a larger campus. With this greater physical capacity, he can increase the cohort size and teach hundreds of developers at a time.

I do hope his vision can come true and the crypto community should consider how they can support Web3Bridge.

What Does The Future Entail?

Having had the opportunity to visit Kenya and Nigeria for nine days, I’ve gained some valuable insights that have led me to some important conclusions about the future — for its workforce, how crypto may play a role and whether we (the west) can support their growth.

Africa Is Uniquely Positioned to Succeed

In my opinion:

Africans share the European time zone,

They speak fluent European languages, especially English and French,

Deep desire to succeed and earn their wealth.

Africans are in an advantageous position to compete in the online arena.

In the digital realm, if a worker is needed for a specific time zone and they can communicate in the same language, then it may not matter if the worker is in Europe or Africa.

Again, to me, the overarching goal to help Africans succeed:

Better crypto rails to provide a reliable path for hiring and paying Africans,

Reduce the key differentiators that allow an online community to distinguish between Africans and Europeans,

Enable African developers to leverage crypto as a software stack and eliminate the role of a trusted service operator.

Long term: The two communities, Africans and Europeans, should become indistinguishable from each other, in the digital realm.

Only then, will Africans by and large have the ability to earn on merit, and not their geographical location.

Africans Understand Crypto

Thanks to the internet and our online communities, Africans are not isolated from the wider Ethereum community.

We met teams and individuals who:

Are building projects on Arbitrum,

Participated at ETHGlobal Hackathons and won bounties,

Learning how to implement Cairo smart contracts for StarkNet.

Aware of Optimism’s retrospective grants,

Are eager to learn about ZKPs, so much so, that Ye Zhang failed to finish his slide deck during both developer workshops.

Africans do not need us, the west, to visit them and preach why they should care about Ethereum or the wider cryptocurrency ecosystem.

Heck, they have a crazy large NFT community.

Africans are already sold on crypto and the number of enthusiasts is steadily increasing.

How Can We Help Africa?

When it comes to understanding how crypto can be used, Africans do not need our help. If anything, we need their help to showcase the use cases.

As this article outlines, how Africans can conveniently access US dollars using crypto helps validate all the technology we are building. It provides indisputable evidence that crypto has product market fit and there are many people who depend on it.

On the other hand, we need to better understand the challenges that Africans face before they can participate in the online economy and be set up to kick-start their own ventures in the cryptocurrency space. Some challenges include:

Lack of government support.

Kenya has no crypto law, but the Government just seized the hardware for WorldCoin, citing its failure to disclose true intentions.

Nigeria banned Banks from participating, but not individuals from using it.

Little to no VC presence.

Angel investing is available, but it is very rare.

Issues around identity makes legal compliance difficult and it can act as a blocker to raising funds.

No time to tinker.

The desire to succeed makes Africans very laser-focused on building the next product.

They lack the free time to simply tinker with technology for fun and this potentially hampers their ability to come up with innovative new ideas.

Global perceptions

Westerns have misperceptions about the capability and the real-world needs of Africans,

Africans can demonstrate their ability and merit, but it needs all of us to amplify it.

Grant Programme for Africa

One solution that came up, time and time again, is the need for a grant programme that is focused on Africans.

There are a few points that I want to make in regards to grant programs and the feedback is relevant for any program (not just one focused on Africa):

Grants should be given to projects and individuals who need it to push the needle,

Grants should be given to individuals who may benefit from time to tinker and better understand research-oriented ideas,

Grants can de-risk the pre-seed landscape for VCs,

Grants should not be seen as a long-term funding source as it is very easy to continue funding projects that should be allowed to fail,

Grants should ONLY be issued when there is clear and indisputable evidence of proof of work by the grantee,

Grants can be offered to foster an environment, connect developers and grow a community who can knowledge share with each other.

Any grant program that seeks to work in Africa, or in any geographical location, really needs local leaders to run it. Grant managers can be paid to review and authorise grants. It can very well be a full-time role.

Most people, even exceptional local leaders, have no experience running or participating in a grant program. Like any system, it is always better to start small and allow it to build up over time. It is wise not to hand over a very large treasury to a brand new grant programme. Grant managers should have time to earn a reputation for how they manage the treasury and demonstrate impacted from the grants.

Grants are NOT a silver-bullet to solve the local problems, especially in Africa. There is only a finite treasury and it can very easily be depleted. It is best to be cautious on how the funds are spent. Grants should be reserved to help the most promising groups and individuals to push the needle on their project. It is “free” money, but it should not be and it cannot be widely available.

To me, Uniswap is one of the the best success stories. Hayden, the founder, was offered a $50k grant by the Ethereum Foundation to pay for audits. That was enough money to pay the audits, push the needle, and led to the tech giant that is Uniswap.

It doesn’t take a lot of money to push the needle. Less is often more.

Finally, there are two issues that block the success of any grant program.

It may not be possible to offer grants to Africans if they cannot adhere to KYC/AML rules.

A local venture capital network needs to emerge that can later fund any success stories.

Both are structural and infrastructure issues that live outside the realm of crypto. Especially the venture capital network, you need ex-founders who are willing to invest and help a new set of founders build large and sustainable companies.

Physical Education

The one thing missing in Africa, but abundant in the west, is on-site education.

In the west, there is an abundance of workshops at conferences, summer and winter schools, available to attend and learn about the core technology that fuels cryptocurrencies. Even more so, many of the educational events are free to attend.

Regrettably, many Africans face constraints when it comes to physically attending crypto-related events.

A significant number of Africans lack passports, and even if they possess one, the need for a visa and the potential financial burden of travel costs present considerable challenges.

They simply cannot come to us.

As an experiment, Ye Zhang and I ran a developer workshop in both Kenya and Nigeria.

To our surprise, software developers showed up and in great (unexpected) numbers too. They asked many good technical questions. Poor Ye, he did not manage to finish his slides, due to the onslaught of questions.

There is an abundance of technical savvy developers in Africa who want to learn about the core infrastructure of Ethereum alongside exotic topics like zero knowledge proofs.

To date, they have exclusively relied on the internet to learn about it, but there is nothing better than in-person interaction with world experts on a topic. Not only from a learning perspective, but to gain inspiration to pursue a topic as experts tend to love their topic and that type of intellectual love is contagious.

This leads me to next steps: We do not really need a conference that shills and markets new Web3 projects to Africans. There is a desire for knowledge sharing and learning.

The biggest contribution we can make to Africans is to organise and run an in-person educational program. Like a summer school — inviting experts to come and teach technical topics.

Final Conclusion

There are several takeaways from the above article:

Crypto rails has found product market fit as a convenient method to access US dollars,

Binance is popular in Africa due to early expansion and facilitating its peer to peer market,

Africans want to earn based on merit rather than geographical location and they have the resilience to pursue it,

Long term goal should be to reduce the differentiators between Europeans and Africans in the digital realm.

Africans face many challenges from lack of regulatory support, inability to travel, difficulty to adhere to KYC/AML, little to no venture capital networks, and simply no time to experiment with new ideas.

Even more so, nearly all Nigerians raised their hands to acknowledge that they lost an opportunity because people could not trust them.

Web3Bridge’s educational program is doing God’s work and the next step is for the west to assist in-person with its own summer school.

One of the impacts of our visit was to help connect the community too. Many of the attendees did not know each other, especially the developers. It sounds like some of the local community leaders will attempt to keep organising more events. As more of us visit, hopefully it’ll help the local leaders build larger communities too.

There are two final topics that I’d like to discuss.

Africans have a fun-loving nature. We may have only visited Nigeria/Kenya, but we met other Africans from Uganda, Ghana alongside others. They happily make jokes about other African nations like Nigerians are all dramatic or They visit Ghana when they need to chill out.

The locals were more than happy to teach me some funny words like Mubaba, Alagba, m’soupa that are compliments for men and women. I took every opportunity to say the phrases and most of the time they laughed, especially the Kenyans.

They even told me that East Africans have round foreheads and West Africans have flat foreheads. lol.

It is very easy, as a programmer, to focus on the wider system and try to evaluate how it can be fixed to the benefit of all. However, we must never forget the people at the heart of this system. It is always worth taking the time to learn about their customs, humour, and to fully appreciate what they have had to give up to make it into the same room as the rest of us.

What is Africa?

One remarkable aspect about Africa is its immense cultural richness and how it impacts how Africans perceive the continent.

In West Africa, there is a Schengen-like arrangement that allows for visa-free travel across several countries. However, it is difficult and not common to travel from East Africa to West Africa (and vice versa). It requires a visa, it is financially costly, and it takes time too. For example, Lagos to Nairobi has a flight time of ~5 hours and may cost >$600 for a return flight.

I noticed that East and West Africa mutually recognise each other as an integral parts of the African identity. On the other hand, they do not consider South Africa or North Africa as “Africa” by the same standard. South Africa is considered more European and North Africa is more Islamic.

The sentiment was exemplified by the fact that no one, who I asked at least, had travelled to Algeria or expressed any intent to do so. This is interesting as my step father grew up in Algeria and he very much considers himself to be African.

I don’t have a great insight to why. I imagine it has to do with cultural differences and Africa’s colonial history. If anyone wants to comment with great reference points, I’d appreciate it!

I hail from Nigeria by origin, having seized the opportunity to attain a doctoral degree in computer software from one of Asia's most esteemed universities. At present, I am engrossed in a Web3 project and concurrently bear the mantle of a technology entrepreneur. My current residence is within the diasporic sphere (Singapore, China and Hong-Kong), where I am engaged in ongoing education, interactive discourse, networking endeavors, and meaningful contributions in the web3 space.

Inevitably, guided by the amalgam of knowledge, garnered experience, and achieved success, a return to Nigeria stands as an imperative. The purpose of this return is to extend support to our fellow countrymen. Interestingly, when I elicit viewpoints from individuals in the Western and Eastern hemispheres, who possess no first-hand acquaintance with Africa, their responses predominantly skew towards negativity. I posit that this tendency stems from an absence of comprehensive understanding of the actual conditions within Africa—an outlook largely shaped by media-driven narratives

However, I have come across an article that significantly distinguishes itself. It presents an exceedingly benevolent and optimistic viewpoint, substantiated by factual information, regarding the prevailing African landscape in the era of Web3 technology. This article, in my estimation, ranks among the finest in its class. It is my belief that its content has the potential to recalibrate prevailing narratives, thereby rendering palpable the influence it has had on numerous Africans aspiring to realize their ambitions without encountering prejudice or hindrances in their journey.

I extend my gratitude for your willingness to share your experiences in Africa with a global audience. It is my fervent hope that this article, much like your contributions, will actively contribute to reshaping perceptions and concretizing the positive impact achievable by countless Africans striving to manifest their aspirations, unimpeded by bias or constraints.

Thanks for this insightful report from being on the ground where it matters!

And do let me know if there are more on-prem education opportunities come up, I'd be totally up to help. While not a dev myself, I can teach a thing or two in crypto, particularly with regards to data, entrepreneurship, project management etc.