Scaling Ethereum Makes Rollups More Useful

Why Vitalik’s latest comments signal evolution and not a retreat from rollups

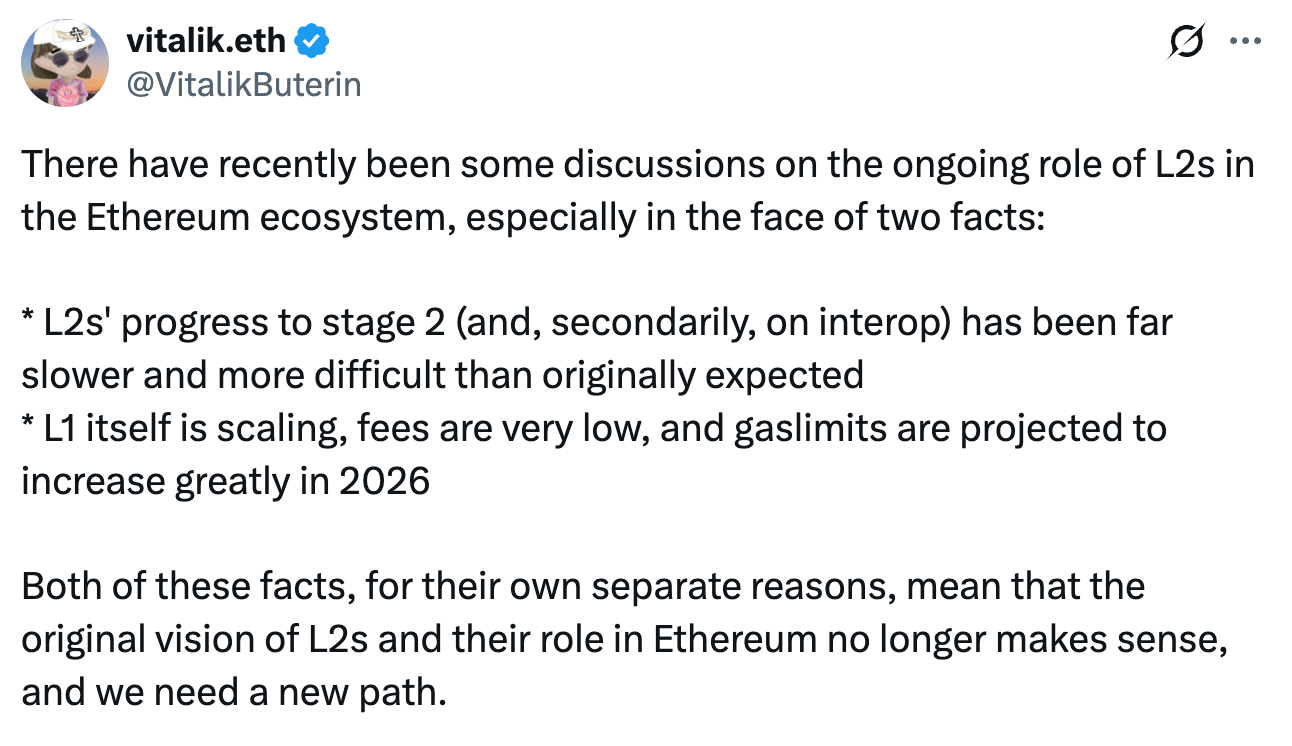

The industry is coming to grips with Vitalik’s new post on rollups which argues that the original framing of the rollup-centric roadmap needs updating as scaling Ethereum L1 becomes an increasing priority.

The response to his tweet is interesting.

Rollups are making counterarguments while others are taking “victory laps” that they were “right” that “rollups were doomed to fail”.

Yet, I feel nearly all responses are missing the point of his tweet.

His message is not that rollups have failed, in fact, it is the opposite. Rollups that have differentiated themselves relative to Ethereum have succeeded hugely, but this is not what was anticipated in the initial vision.

To understand why, let’s dive down memory lane on how rollups came to be, how rollups have evolved over the years, why achieving Stage 2 security is not necessarily an immediate priority, and the type of product market fit that rollups have found.

We will see that rollups have succeeded, but not as Ethereum shards extending blockspace. Instead, rollups have succeeded as independent economic ecosystems that seek to offer best-in-class security when accessing assets (and liquidity) on Ethereum.

The long-term success of rollups depends on a highly scalable Ethereum L1 that remains the primary source of assets and liquidity.

Quick dive into the history of rollups

Back in 2016, Ethereum adopted the same philosophy of Bitcoin, that a home computer should have the capability to independently verify the entire chain from genesis.

There are many good reasons to take this philosophy approach. It prioritises decentralisation as a core value, protects the chain from hostile takeover, and helps spot bugs/exploits immediately.

At the same time, it also concludes that Ethereum will never achieve 1,000 tps with low fees, and it’ll be impossible for the world’s transactions to be processed by a single chain.

Back then, there were two scalability approaches under consideration:

Sharding. Partition the blockchain into different processing units, where each unit only processes a subset of transactions.

Off-chain solutions. Take transactions “off'“ Ethereum, process them elsewhere, and bring the result back to Ethereum.

Proposed solutions for Sharding often replicated how it works in classical database theory. However, they were Frankenstein solutions, monstrous, and in many ways perceived to be impossible to implement at scale, simply due to their complexity.

Off-chain solutions were often very simple to reason about and implement. I spent most of my own time working on State Channels. However, channels only work for a small set of parties and were not applicable for 90% of applications. This became obvious to me after trying to build a battleship game and discovering it was not a real solution to the problem.

Then, in 2017, there was a scalability breakthrough thanks to Joseph Poon and Vitalik Buterin. They introduced the concept of Plasma which effectively combines the concepts of sharding and off-chain solutions.

Plasma failed, but eventually evolved into the rollup-centric roadmap from 2019 onwards.

Rollups, as a Sharding Solution, Could Have Same Security as Ethereum.

Rollups, from a technology perspective, moved the execution of transactions off Ethereum (like off-chain systems) while fragmenting transactions according to the relevant smart contracts (like sharding).

It was generally assumed that rollups could replicate the same, if not better, security guarantees offered by sharding protocols. If this was accomplished, then rollups could effectively act as a direct extension of Ethereum. This led to the following:

Multiple teams building their own version of a rollup, effectively a shard, with the desire that at least one team gets it right.

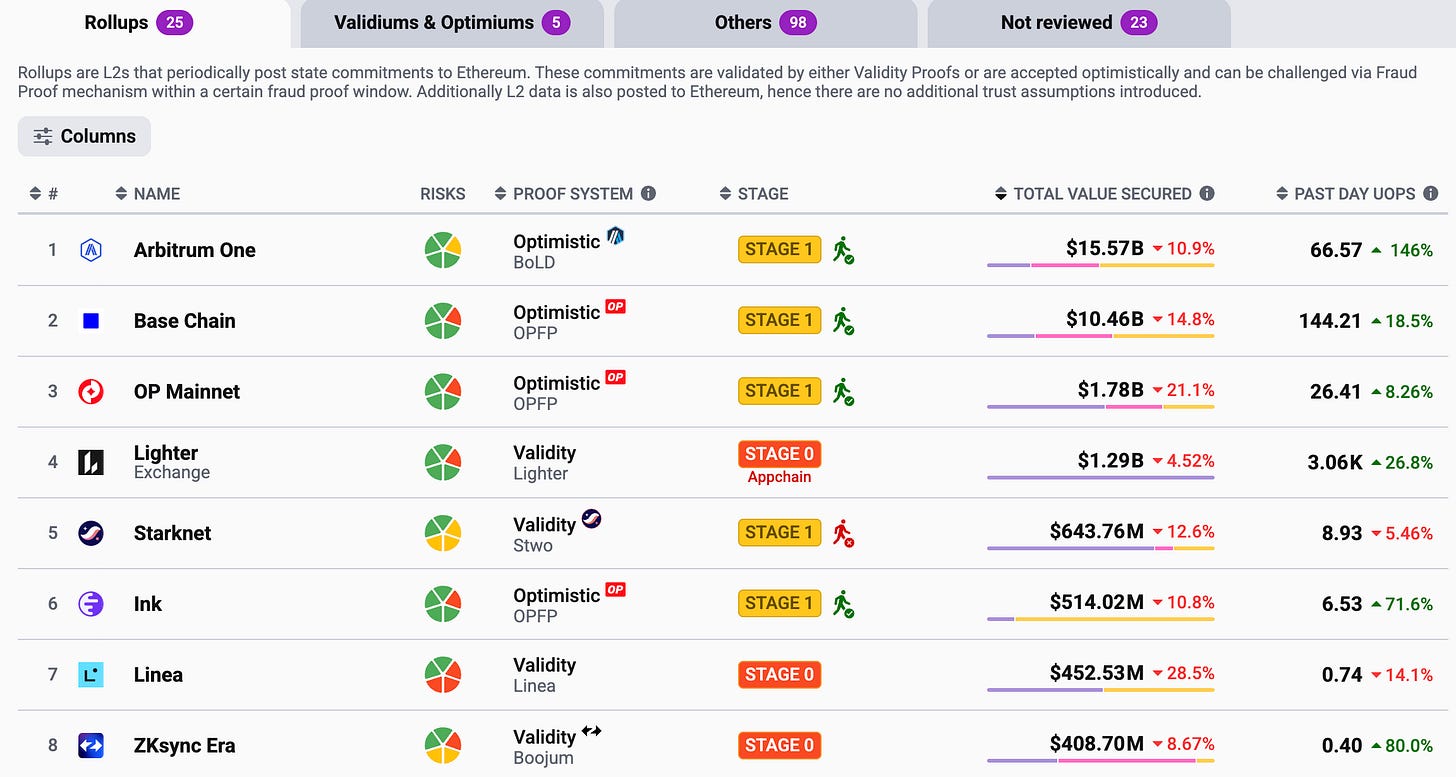

L2Beat emerging as a referee to hold the teams accountable that they were indeed building rollups according to the initial vision of extending Ethereum’s blockspace (securely).

Over the years, the community agreed to a framework on how to evaluate whether a rollup was on the path to achieving the goal of becoming a true extension of Ethereum.

Out of all the teams that attempted to build a rollup, there are only a few managed to achieve Stage 1 status and build an ecosystem that is worthwhile for users to transact on. Of course, this includes Arbitrum, a team I decided to join a few years ago.

Desirability of Stage 2 and Frustration To Achieve the Rollup-Centric Vision

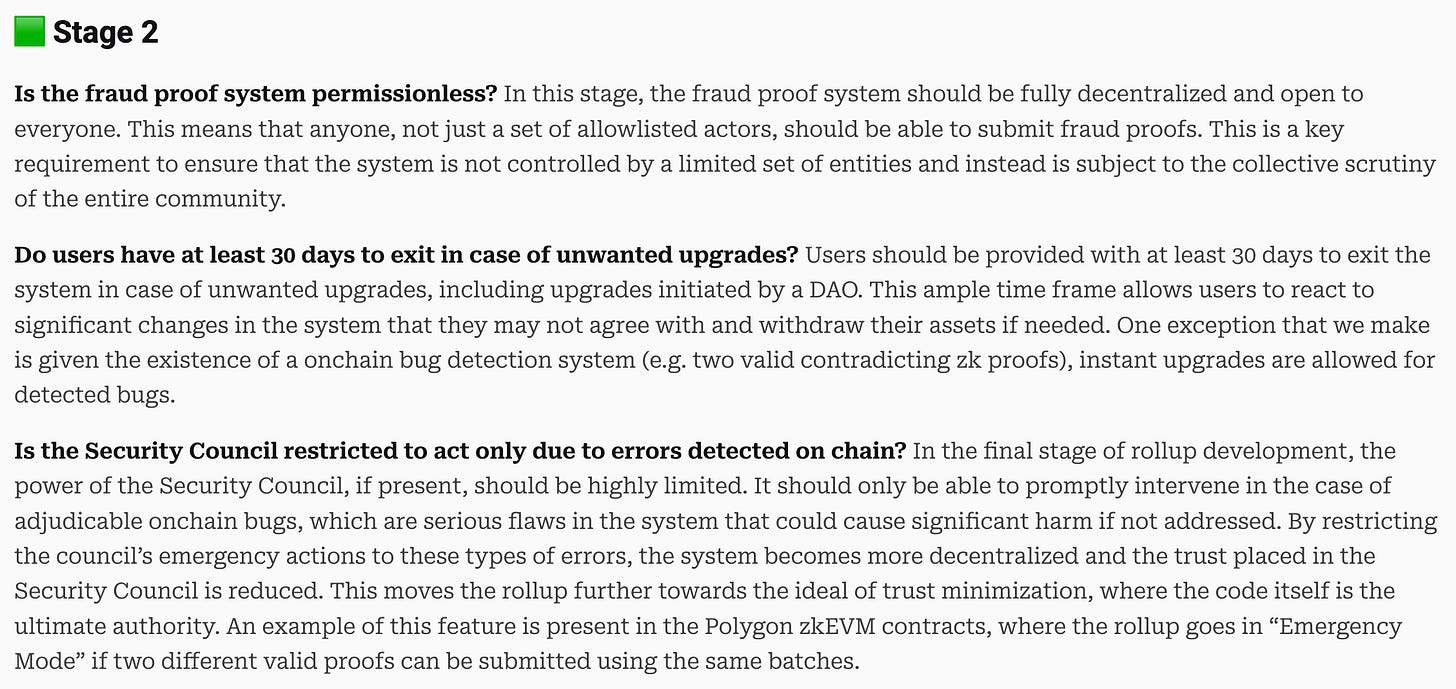

The primary difference between Stage 1 and Stage 2 is whether there is a security council with the authority to immediately upgrade the chain:

Stage 2. Security council is severely restricted to only handle soundness errors that are detectable on-chain (i.e., different valid proofs for the same checkpoint) or simply no security council.

A rollup is classified as Stage 2 if there is no longer a trusted committee with the ability to perform instantaneous upgrades.

The community is split on whether this is desirable for users and operators.

I’m in the camp that it is overall bad for users if the security council is removed. It limits security to reactionary measures and stops the team from fixing known exploits quickly before they become serious risks. That is a choice that Ethereum makes, but rollups don’t need to make the same choice.

Another point, mentioned in Vitalik’s original tweet, is that enterprises want to maintain a level of control over the system. The legal system, and the consequences of removing safety wheels, is part of their threat model too.

Of course, this rationale is at odds with the original rollup-centric vision.

Staying at Stage 1 means the rollup will not be a fully trustless system as there is an additional trust dependency beyond just Ethereum.

If a rollup wants to follow the ideology behind the rollup-centric vision and truly be an extension of Ethereum, then it must achieve Stage 2 status by nerfing the security council or removing it altogether.

Rollup Product Market Fit at Odds With the Original Vision for Rollups.

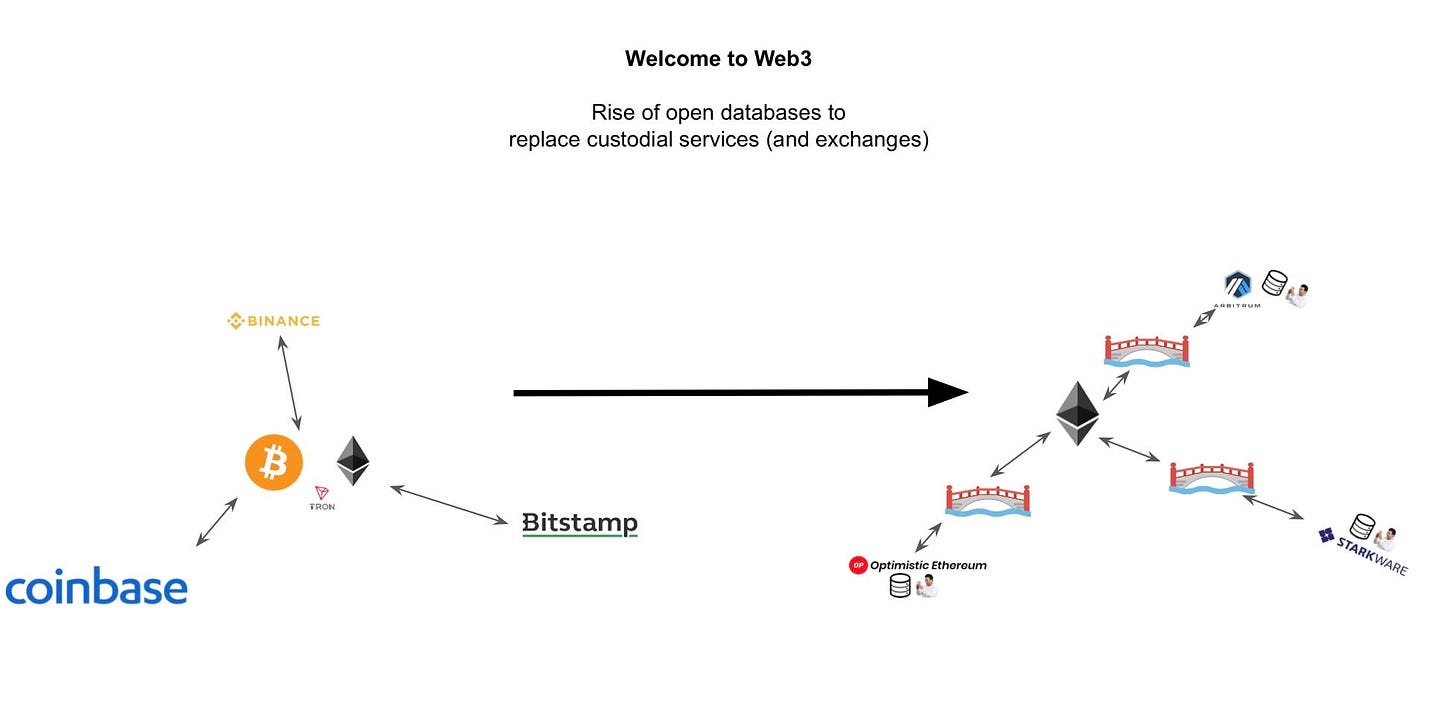

The drift on expectations compared to reality has to do with the type of product market fit that rollups have found.

The product fit is not necessarily acting as a strict extension of Ethereum, but empowering operators to embrace a Web2 architecture with all the benefits of Web3.

Large institutions like Coinbase, Robinhood, and others, want to distribute services to their customers, and rollups are emerging as a compelling technology stack for this purpose.

Every rollup project has a strategy focused on institutions:

Customisable Arbitrum chains,

Optimism’s Superchain,

ZkSync’s “bank chain” motto.

This is not surprising as there are many reasons why institutions will want to adopt rollups:

Control over the user experience,

Add functionality that doesn’t exist on Ethereum,

Experiment with different MEV-aware architectures,

Capture value from their own distribution channels.

Most importantly, rollups are economic actors. They compete to attract users, developers and projects, seeking to maximise the utility and reach of their own ecosystems.

This is very different behaviour from what we would expect of Ethereum shards. Rather than passive extensions of L1 blockspace, rollups are competitive execution environments seeking access to Ethereum’s liquidity.

Competition drives experimentation, differentiation, and a better experience for users.

This brings us back to the security framework managed by L2Beat.

Stage 1, to date, already offers stronger user (and operator) protections than typical Web2 infrastructure while still allowing the operator to respond quickly to critical security incidents:

Users do not necessarily have to trust the operator on a day-to-day basis alongside an escape hatch to withdraw from the system if issues do arise.

Operators can rely on the technology stack to protect billions of dollars with the ability to perform emergency upgrades if zero-day exploits are discovered.

There is a risk that the security council is compromised and they steal all funds in the rollup.

With that in mind, achieving Stage 1 is good enough for many operators. The benefit of becoming a Stage 2 rollup is not strictly superior as it depends on technical maturity, governance needs, and regulatory context.

Scaling Ethereum L1 is a MUST for Rollups To Win

Let’s assume that rollups are indeed an ideal technology stack for companies to adopt, build products on, and rely upon to distribute services to their customers.

There is still a missing piece that all companies who adopt rollups will depend on:

An Ethereum L1 that scales to become the primary source of assets and liquidity on earth.

Why?

Take a moment to think, fundamentally, why rollups are useful:

Best-in-class access to liquidity. Rollups allow the operator to access liquidity on Ethereum and for the assets on Ethereum to be maximally protected when they are transacted with on the rollup.

If Ethereum fails to scale, then there will be no assets on the chain, and thus there is no point to deploy rollups on Ethereum.

The success of rollups depends a scalable Ethereum L1.

In fact, it goes a bit further than that, we should expect to see rollups deploy bridges to several networks, like the Base-Solana bridge, as rollups seek access to liquidity on all public venues.

Ethereum should remain the primary venue for liquidity and the anchor that secures the rollup for users & operators.

In hindsight, one of Ethereum’s biggest strategic mistakes may have been inheriting Bitcoin’s scaling conservatism rather than anchoring scalability to real-world conditions, like the yearly increase in hardware and bandwidth resources available.

I believe this philosophy is actively being dropped by the community as everyone is changing their minds on what it means for Ethereum to scale.

Ironically, I was a “big blocker” during the Bitcoin block size wars, but also fell prey to believing Ethereum couldn’t scale beyond what it does today in the name of decentralization.

Really? What if Ethereum Scales Infinitely? Rollups Should Die?

Let’s pretend Ethereum infinitely scales and transaction fees are so cheap that anyone can transact.

In this world, do you believe that cryptocurrency exchanges like Coinbase, Binance or Kraken will disappear?

Most people, I’d assume, will answer no.

Why? because exchanges offer functionality and services that are difficult to replicate on Ethereum.

The same is true for rollups.

This brings us back to Vitalik’s original tweet.

Rollups need to differentiate on functionality. Rollups shouldn’t simply be boring clones of the EVM. Boring clones will die off, but rollups that offer fundamentally different functionality will thrive.

Rollups will increasingly compete as economic ecosystems. They will continue to experiment with execution environments, MEV-aware designs, user acquisition strategies, and ultimately capture value for the wider ecosystem.

Ethereum scaling and rollup differentiation are complementary, not competing strategies.

Rollups ultimately succeed when Ethereum L1 succeeds because it is the primary source of assets, liquidity, and security anchoring.

Vitalik’s tweet reflects an ecosystem recalibration rather than a retreat from the rollup-centric roadmap. The time to scale Ethereum L1 has arrived and we should approach it with confidence rather than hesitation.